Happy New Financial Year!

The financial year 2022-2023 has been both a challenging and eventful time for many Australians.

From high-interest rates and increasing inflation to threats of market downturns and recession, we’ve really seen it all!

Despite these hurdles, Australian real estate has never failed to show resilience, with numerous housing markets across the country consistently delivering record-breaking figures and valuable returns to investors.

Now, with FY23 coming to a close, our team at Upstate is eager to shed more light on the current state of the property market, outline some milestones in action and share some of the impressive sales results achieved over the last 12 months.

To help set your sights on the future, we’ll also share our predictions for real estate as we embark on the new financial year.

Let’s do it.

What’s UP with the Sydney property market?

Sydney Residential Real Estate

Last month, the First Home Buyers Assistance Scheme was expanded for larger loan sizes.

Through this recently passed legislation, first home buyers in New South Wales will now be able to take advantage of increased stamp duty exemptions and concessions. The threshold for stamp duty exemptions was raised to $800,000 from $650,000 while stamp duty concessions now apply for properties up to $1M.

These adjustments aim to help more Australians enter the property market and buy the home they need.

The RBA, on the other hand, has recently increased the cash rate to 4.10%, and Economists have predicted that there will be at least one more increase of 0.25% before we see cash rates fall again.

While these ongoing rate rises have led to a 10-15% correction in property prices across Sydney’s Northern Beaches, we believe there’s no need for sellers and investors to be concerned.

Sydney property market prices are 5.8% lower than they were 12 months ago but are still 14.8% higher than pre-COVID figures. The value of properties in Sydney have also increased by 1.7% in June, taking the cumulative recovery since January to 6.7%.

The Northern Beaches property market continues to perform strongly as well, with an auction clearance rate of 69% compared to only 56% last year.

“We’ve seen enquiries across the Sydney Metro market down by about 28%, however on the Northern Beaches, we’re only down about 3%, once again showing the resilience of our local market,” says Peter Mosedale, Upstate Director.

Sydney Commercial Real Estate

Commercial real estate on the Northern Beaches is also thriving, regardless of recent uncertainties in the economy.

One notable area, Dee Why, has successfully positioned itself as the CBD of the Northern Beaches.

As the largest real estate agency in Sydney’s Northern Beaches, our team at Upstate has also achieved some remarkable results on the commercial front.

“We were able to secure some highly successful results for our commercial real estate clients, including several sales over $15,000,000 in tightly held areas such as Balgowlah, Brookvale, Lindfield and Belrose.” says Vincent West, Upstate Director

Sydney Leasing

John Hall, Upstate’s Senior Business Development Manager, has shared some first-hand insights on Sydney vacancy rates, rental yields and average rental prices during the past financial year.

According to John, the average asking rental prices for houses are up by 19.1% and unit prices have also increased by 20.8%. And while apartment yields have dropped from 4% in January to 3.2% in June, house yields have held steady from 2.9% in January to about 2.8% last month.

John also highlights that vacancy rates have gone from 1.3% in January this year to 2.1% in June, following the trend from 2022.

Overall, he noted that the Sydney Northern Beaches’ rental market has performed well over the past 12 months, and will continue to do so this financial year.

“Although inquiry numbers and numbers of attendees to open homes are slightly down, we are still seeing good properties being leased for what they are worth. As you can see by the stats on average asking price, things are still increasing in regard to rental returns,” says John Hall, Upstate Senior Business Development Manager

Upstate’s results for 2022-2023

At Upstate, we are committed to achieving outstanding results and take pride in our ability to deliver exceptional outcomes.

The successes we have achieved in FY2023 are a testament to our unwavering dedication and hard work in helping property buyers, sellers and investors reach their real estate goals.

Let’s have a look to get a deeper insight into the movements in the market.

Residential Property

In terms of residential sales, we have listed 391 properties and sold 285 houses over the last 12 months – with only an average of 25 days on the market. Meanwhile, our auction clearance rate for residential and commercial sales combined is at 61.72%

Our highest sales price reached a staggering $7,750,000 for a property at 23/7 South Steyne, Manly!

We also recorded a total of 15,939 attendees at our open homes, both for residential and projects over the last year.

Overall, Upstate has gained a substantial market share of 12.1% in the residential segment of the Sydney Northern Beaches area this financial year 2022-2023.

Projects/Developments

Our Projects team has also performed outstandingly over the last 12 months.

8 of the 15 projects available for sale have already been listed. More than 666 properties between Canberra and Queensland are also being sold in the market at present.

Most importantly, when it comes to project developments, Upstate holds 75% of the local market share.

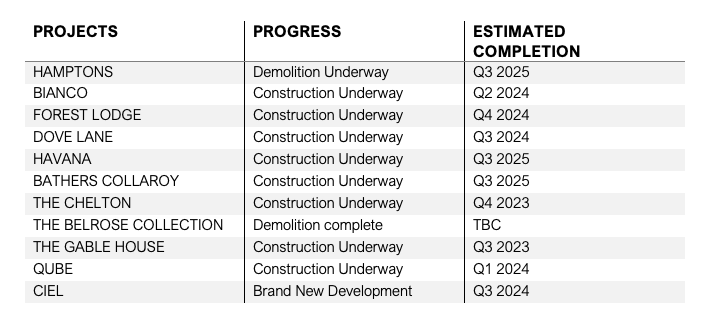

Here’s a quick breakdown of our most recent developments:

Commercial

Our team at Upstate continues to exceed expectations, especially in commercial real estate.

For the financial year of 2022-2023, we have recorded our highest commercial sale in the last 10 years – an $18M property located at 61-63 Kenneth Road, Balgowlah. We also recorded 5 sales of over $5M each.

There’s a reason why we are consistently #1 in the region, with a 30% market share in commercial real estate!

“Values of investments have dropped a little with rates rising and this is affecting yield. However, at Upstate, we don’t let things beyond our control slow us down. We do our best to continuously maintain a strong level of demand. In fact, everything we list keeps getting offers,” says Peter Mosedale, Upstate Director.

Leasing

For the financial year 2022-2023, we have leased 592 properties and recorded our highest leased price of $2,400.

We have also kept our vacancy rate at 1.5%, with an impressive average of just 13 days on the rental market.

Furthermore, we have also seen 8,427 attendees at our open homes for leasing this financial year.

Asset Management

Upstate has seen equally great results in Asset Management.

This FY23, we welcomed 45 new managements and 29 new landlords into our community.

We also have a proud reputation of being #1 in Sydney’s Northern Beaches, providing high-calibre asset management services for residential and commercial properties alike.

All of these remarkable achievements exemplify the outstanding results we consistently deliver at Upstate. Now, let’s discuss what we can look forward to in the next 12 months.

Our property market predictions for the FY24

In line with Domain’s new report, we also foresee that housing prices will bounce back this FY24.

Our projections at Upstate are that property values in capital cities like Sydney, Adelaide and Perth will reach new highs, pointing towards a continued recovery of Australia’s housing market this coming financial year.

This outlook aligns with our discussions with a prominent market economist earlier this year, who told us that adjustments in the Australian real estate market have largely taken place, and there may only be a little more to go at the worst.

Meanwhile, John Hall, Upstate’s Business Development Manager, believes that these increasing property prices will drive many people to rent.

“A lot of properties are still out of people’s price ranges, which will encourage them to continue renting. On the other hand, there will also be property buyers who will rent their purchased home for cost efficiency. They will opt to rent a more affordable home while also generating additional income from the house they own,” says John Hall, Upstate Senior Business Development Manager

Looking at Upstate in 2023

Overall as a business, we have achieved so much this financial year 2022-2023. Some highlights include:

- 88,793 social interactions

- 44,864 email inquiries

- 5 groups through on average per open home

- 695 total number of leases

- 409 total number of sales

- Over $685M value sold

- Auction clearance rate that’s 19% higher than Northern Beaches’ clearance rate

- 388 completed jobs by our Concierge service

So, this FY2024, we aim to pursue more growth opportunities for our team and introduce more digital initiatives to further expand our service capabilities:

- With over 75 staff and new salespeople joining us, we have begun implementing more training programs such as commercial breakfast events, level up sales training sessions and property management development events.

- Recently, we launched Australia’s FIRST-EVER Commercial Vendor App to keep clients up to date with real-time property updates and activities in the property market.

- We also have a digital property report tool that can help assess a property’s worth, especially if you’re planning to sell this winter.

Whatever FY2024 (or the future!) may hold, Upstate is dedicated to being right by your side throughout your property journey to help you find yourself in a better place.

If you have any questions about this report, about the market or about your property, don’t hesitate to contact us.

The Upstate team