With Sydney’s residential property market experiencing a distinct cooling in recent months, many investors are turning their attention to commercial real estate instead.

The boom in interest in commercial property is being driven by mum and dad investors, many of whom see potential yields between 4%-8%. That’s decisively better than the 2%-4% yields that residential property is returning.

Everything from childcare centres, to fast food outlets and even service stations are attracting investors’ attention. The boom in commercial real estate saw a record $19billion worth of property changing hands in the 2018 financial year, with no indication that this trend is slowing.

Why commercial property?

There are some distinct advantages to investing in commercial property. Apart from higher yields, commercial tenants usually remain in the same property for much longer than residential tenants. Additionally, outgoings such as council and water rates are usually paid by the tenant in a commercial property, rather than by the landlord.

Another factor driving interest in commercial property has been the re-zoning of many former industrial sites for residential construction over recent years. This has led to a shortage of commercial real estate in many parts of Sydney, giving a boost to prices. Conversely, the rapid expansion of apartment stocks has seen residential prices cooling. When investors compare the long-term growth prospects of residential vs commercial real estate, they are clearly seeing the benefits of the latter.

When it comes to deciding what type of commercial real estate to invest in, it is important to recognise that not all commercial property is the same. Commercial properties differ wildly in characteristic, size and function. All these considerations will affect price growth.

When it comes to deciding what type of commercial real estate to invest in, it is important to recognise that not all commercial property is the same. Commercial properties differ wildly in characteristic, size and function. All these considerations will affect price growth.

The September 2018 RICS property monitor report identified the differences between various types of commercial real estate in Australia. It showed a positive 33 score in office sentiment, yet a negative 23 score for retail. So, it pays to do your homework when deciding the best type of commercial property to invest in.

What’s in Store for Commercial Property in 2019?

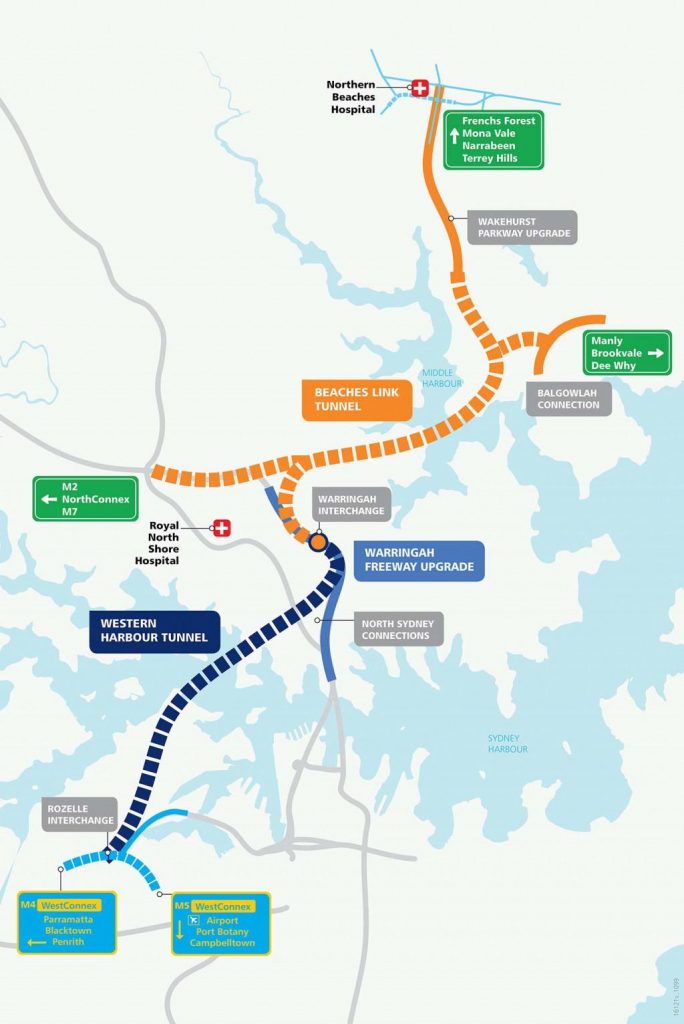

2019 is shaping up to be a big year for the Northern Beaches. Leading up to the NSW state election in March, the government has proposed major new infrastructure developments, including the Western Harbour Tunnel and Beaches Link. The proposal will link the Wakehurst Parkway to the Gore Hill Freeway, connecting to a new harbour tunnel. If it goes ahead, such a substantial investment in infrastructure will help boost property values, including commercial property values, across the Northern Beaches.

Another item to watch out for in 2019 are interest rates.

While sentiment was strong that rates would rise in 2018, the cooling residential property market ensured that the Reserve Bank kept rates steady at 1.5%. Some analysts are now predicting that rates may even be cut further if the housing market remains soft. Any reduction in interest rates would put downward pressure on commercial rental yields.

For commercial real estate investors, it’s crucial to consider both the rental income, as well as longer term capital growth. You want to make sure you have a quality asset, in a high-demand location, that will appreciate over time even if rents drop periodically.

Therefore, if you’re looking for investment opportunities in property, you should seriously consider the advantages of commercial property in a highly sought-after area of Sydney, such as the Northern Beaches, which has strong long-term growth potential.

Call Upstate now to find the right commercial properties in the Northern Beaches that will suit your investment strategies or take a look at our Commercial Properties for Sale.